Singapore turns 60 in 2025, the budget unveiled by Prime Minister Lawrence Wong, introduces a comprehensive suite of measures aimed at addressing immediate economic challenges and positioning the nation for sustained growth. The 2025 Singapore Budget well covered from supporting Individuals and households, to economic growth and business incentives till long – term startegic initiatives to addresses Singapore’s future energy needs and environmental sustainability.

“Onward Together for a Better Future Tomorrow”, lets us review below what are the implication of this year budget to individuals and businesses.

Table of Contents

For Individual, household and community

Supporting Singaporens for Better Tomorrow

1. Enhanced Subsidies and Cash Payouts:

Singaporeans can expect increased subsidies, tax rebates, and cash payouts, such as the SG60 vouchers and CDC vouchers

2. Cost-of-Living Support:

Measures like U-Save rebates and Climate Vouchers will help households manage utility costs and promote energy-efficient upgrades

3. Support for Families:

Initiatives like the Large Families Scheme and LifeSG credits aim to ease the financial burden on families with children

4. Supporting mid-career workers’ challenges:

To support Singaporeans aged 40 and above to upskill and reskill, enabling individuals to remain competitives in the job market

The 2025 Singapore Budget recognised the financial challenges and pressures faced by individuals, families, seniors including vulnerable families and persons with disabilities, and introduces a range of initiatives focused to relief the financial pressures associated with raising children, addressing long-term care needs of ageing populations and enhance resiliences of vulnerable groups.

** Yellow highlights intiatives indicates there is tax changes

| SG60 Package | Individuals & Communities |

|---|---|

| S$600 SG60 Voucher | Singaporean aged 21 to 59 |

| S$800 SG60 Voucher | Singaporean aged 60 and above |

| S$60 | Baby gift for all Singaporean born in 2025 |

| 60% Personal Income Tax Rebate (capped at S$200) | Tax Resident for YA 2025 |

| S$100 | Active SG members credit Top-up |

| S$100 | Cultural Pass Credit for Singaporean aged 18 & above to purchase tickets for eligible local performance / exhibitions |

| S$600 | Rental Support – each stall hawker centres and markets (Government & Government appointed operators) |

| S$1 billion | Over next 20-30 years to upgrade and build hawker centres |

| S$100 million | Top-up and 5 years extension to Cultural Matching Fund |

| S$250 million | SG Gives Matching Grant |

| S$270 million | Top-up and 3 years extension to Tote Board’s Enhanced Fund-Raising Programme |

| S$60 million | Over 5 years for Self-help groups |

| Families and households support initiatives | |

|---|---|

| Cash | Singaporean aged 21 and above |

| S$100 to S$600 | Assurance Package |

| S$450 or S$850 | GST Voucher Scheme for lower and middle-income Singaporeans |

| Medisave | |

| S$150 to S$450 | Singaporean aged 65 and above |

| S$500 | Additional Medisave Bonus for Singaporeans born in 1950 to 1973 with lower Medisave balances |

| Full-day Childcare | |

| Monthly fees will be capped at S$610 for anchor operator centres and S$650 for partner operator centres. | Lower monthly full-day childcare fee caps in Government-supported preschools to reduce childcare expenses |

| Child LifeSG Credits or Edusave Account / Post-Secondary Education Account (PSEA) Top-Up | |

| S$500 | Child LifeSG credits for Singaporean Children aged 12 and below |

| S$500 | Edusave Account / PSEA Top-up for all Singaporean children aged 13 to 20 |

| New Large Families Scheme | |

| S$5,000 increased in Child Development Account First Step Grant | For each third and subsequent child born from 18 Feb 2025. From current S$5,000 will double to S$10,000 |

| S$5,000 Large Family Medisave Grant | Mother’s medisave accounts for each third and subsequent child born from 18 Feb 2025 |

| S$1,000 Large Family LifeSG Credits | For each third and subsequent child, in the years child turns 1 to 6 |

| CDC Vouchers | |

| S$800 | Singaporean household |

| U-Save | |

| S$440 to S$760 | HDB Households |

| S&CC Rebate | |

| 1.5 to 3.5 months Offset | HDB Households |

| Climate Vouchers | |

| S$400 (including S$100 top-up) | HDB Households |

| S$400 | Singaporean Private property household |

| Seniors Initiatives | |

|---|---|

| Next 5 years Matched Medisave Scheme | Under this scheme, the government will match every dollar of cash top-up made to the MediSave Account (MA) of eligible CPF members, up to an annual cap of S$1,000. This matching grant will be disbursed to eligible members in the following year. |

| Higher long-term care subsidies and grants | The government will increase subsidies and grants for various long-term care services, including nursing homes, day care centres, and home-based care. The income eligibility criteria for these subsidies will also be broadened to cover more households. |

| Higher home Caregiving Grant | Increase up to S$600 a month and raising the PCHI (Per capita household income) eligibility threshold from S$3,600 to S$4,800. |

| Expand Enhancement for Active Seniors (EASE) programme | The Enhancement for Active Seniors (EASE) programme, which helps seniors make their homes safer and more elder-friendly, will be expanded to include Singaporean private property households for the next three years. |

| Vulnerable Families and Persons with Diabilities Initiatives | |

|---|---|

| Enhancements to the Fresh Start Housing Scheme | The Fresh Start Housing Scheme, which helps families with children living in public rental flats transition to homeownership, will be enhanced. Eligible families will now receive a S$75,000 grant, up from S$50,000. |

| Higher ComCare assistance rates | To provide greater financial support for vulnerable families, ComCare assistance rates will be increased. This includes both short-to-medium-term and long-term assistance, with adjustments based on household size, needs, and income. For example, a single-person household receiving long-term assistance will see their monthly payout increase by S$120, to a total of S$760. |

| Extension of Enabling Employment Credit | The Enabling Employment Credit, which provides wage offsets to employers who hire persons with disabilities, will be extended to 2028. |

| Higher subsidy rates for adult disability services | Subsidy rates for various adult disability services will be increased, and the income eligibility criteria will be broadened to cover more households. |

| Matched Retirement Savings Scheme for persons with disabilities | A new Matched Retirement Savings Scheme will be introduced for Singaporeans with disabilities of all ages. This scheme will provide a dollar-for-dollar matching grant for cash top-ups made to their CPF Retirement Account, up to a cap of S$1,000 per year. |

| Matching grant for Special Needs Trust Company (SNTC) trust accounts | The Home Caregiving Grant, which provides financial assistance to families caring for loved ones with moderate to severe disabilities, will be increased from S$200 to S$600 per month. |

| Respite Care Services | To provide caregivers with temporary relief from their caregiving duties, the government will continue to subsidise respite care services. These services offer short-term care options, allowing caregivers to take a break and recharge. |

| Higher home Caregiving Grant | Increase up to S$600 a month and raising the PCHI (Per capita household income) eligibility threshold from S$3,600 to S$4,800. |

| Encouraging Lifelong Learning | SkillsFuture & upskilling initiatives |

|---|---|

| New training allowance | New S$300 monthly training allowance from early 2026 for selected part-time courses. This is to support training cost of individual and to encourage more individuals to pursue further education. |

| Enhanced Workfare Skills Support | From early 2026 for lower-wage workers aged 30 and above. There is monthly allowance available for selected part-time and full-time courses. |

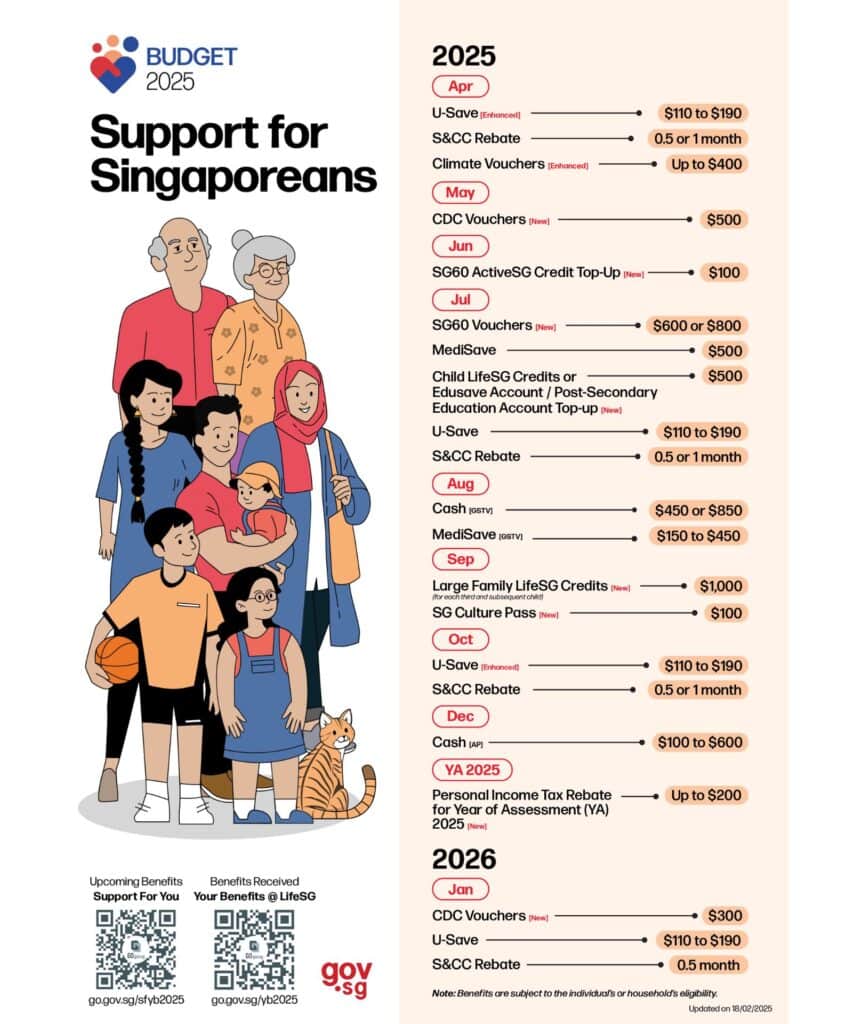

Budget payout calendar for Individuals/households

Taken from https://www.gov.sg/budget-2025 on 22nd Feb

For Businesses and Enterprises

Empowering Business for Growth and Success

1. Managing business costs:

Businesses will benefit from a 50% corporate income tax rebate, capped at $40,000, and a minimum cash grant of $2,000 for eligible companies and enhanced co-funding levels under the Progressive wage Credit Scheme to manage rising wage costs

2. Productivity and Innovation:

The National Productivity Fund will receive a $3 billion top-up to support investments in productivity-enhancing technologies and S$1 billion investment in R&D infrastructure

3. Strengthening Enterprise Ecosystem:

Extend support schemes, tax incentives and global programme to strengthening the business ecosystem

4. Enhancing Infrastructure and Green Sustainable Economy

5. Supporting Workforce Transformation:

To support companies to transform and upskill their workers

The 2025 Singapore budget, as outlined by Prime Minister Lawrance Wong, includes several measures aimed at supporting business gowth and ensuring economic resilience. Here are the key initiatives:

** Yellow highlights intiatives indicates there is tax changes

| Corporate Income Tax (CIT) Rebate | To reduce the burden of corporate income tax with 50% rebate on tax payable for YA 2025, capped at S$40,000, minimum S$2,000 per active company with at least one local employee in 2024. This repeat the same measure as per last year to provide immediate tax relief to support the company on managing high rise costs especially small medium enterprises (SMEs). |

| Progressive Wage Credit Scheme | The PWCS to uplift lower-wage workers and ensure inclusive growth. This helps business to manage the operational cost and support retention efforts. Now cover 40% of wage increases in 2025 and 20% in 2026, up from the earlier rates of 30% and 15%. |

| National Productivity Fund top-up | S$3 billion top-up to National Productivity Fund to support the businesses to invest in new technologies, upgrade equipment and train workforce in order to compete effectively in cutting-edge sectors. This fund will support various initiatives including investment credits and cash grants, providing businesses with strategic resources they need to innovate and scale. |

| Investment in Research and Development (R&D) | S$1 billion will strengthen the development of R&D infrastructure in Singapore. This investment will support the development of advanced facilities and equipment, seeking to attract top researchers and foster collaboration between academia and industry. |

| New Enterprise Compute Initiative to support AI adoption | A new S$150 million Enterprise Compute Initiative will help businesses to reduce the burden of adopting AI tools cost to improve the business efficiency through cloud partnerships. Eligible companies will be able to work with leading cloud service providers for access to AI tools, computing power and consultancy services. |

| Extension of Double Tax Deduction for Internationalisation (DTDi) scheme | DTDi scheme allows businesses a 200% tax deduction on qualifying market expansion and investment development expenses. Initially scheduled to end on 31 December 2025, the scheme will now continue until 31 December 2030, providing continued support for companies international growth. |

| Enhanced corporate tax rate for fund managers | An enhanced corporate tax rate tier of 5% will be introduced under the Financial Sector Incentive – Fund Management (FSI-FM) Scheme for newly listed fund managers meeting certain conditions. This lower tax rate aims to encourage fund managers to list in Singapore and strengthen the asset management industry. |

| Tax exemption for fund managers | A corporate tax exemption will be introduced for management and advisory fees earned by qualifying fund managers from funds that invest substantially in Singapore-listed equities. This exemption aims to promote investment in the local equities market and enhance its liquidity. |

| Support for mergers and acquisitions (M&A) | The M&A scheme provides tax benefits for qualifying acquisition expenses of the ordinary shares of another company, the M&A allowance to be written down over five years, based on 25% of up to S$40 million of all the qualifiying acquisition expenses per YA and 200% tax deduction on transaction costs incurred qualifying acquisitions (Subject to an expenditure cap of S$100,000 per YA) |

| Enhancements to the Enterprise Financing Scheme (EFS) | This scheme is to help businesses to access financing more readily across all stages of growth. Firstly, Trade loan will be permanently increased from S$5 million to S$10 million. Secondly Mergers and acquisitions loan will enhanced beyond equity acquisitions to support targeted assest acquisitions from 1st & April 2025 to 31 March 2030. This will provide more flexible and holistic financing support for Singapore enterprises pursuing inorganic growth opportunities. |

| Market Readiness Assistance (MRA) Grant | This grant helps companies to expand into new markets overseas by defraying the costs of overseas market promotion, business development, and market set-up. The enhanced grant cap of $100,000 per new market will be extended till 31st March 2026. |

| Development of Singapore’s equities market | There is new tax incentives to support development of equities market, to encourage more corporate listing on Singapore Exchange (SGX) while supporting fund managers investing in Singapore-listed equities will gain additional incentives. i) Primary listing will receive 20% CIT rebate. ii) Secondary listing involving share issuances will receive 10% CIT rebate. With criteria of ramain listed for at least 5 years to ensure long-term commitment. The rebate will be capped at S$6 million per YA for qualifiying entities with market capitalization of S$1 billion and above, for those below the threshold will& be capped at S$3 million per YA. |

| Private Credit Growth Fund | S$1 billion private credit growth fund is to support private credit market growth to provide financing to business growth especially for SMEs. This initiative will help to attract more private credit players and giving more the financing option for local companies which may at times have difficulties accessing to traditional bank loans. |

| Global Founder Programme | Government will launch Global Founder Programme under Singapore Economic Development Board (EDB), this help multinational companies and entrepreneurs to access to funding network, global talent pool and strategic partners program to build and scale the businesses in Singapore. |

| Tax deductions for Cost-Sharing Arrangements (CSAs) | Companies can claim a 100% tax deduction on payments made under approved CSAs for innovation activities, even if these activities do not strictly fall under the definition of “research and development.” This measure encourages collaborative innovation and allows businesses to deduct expenses related to a wider range of innovative activities. |

| Enhanced Employee Equity-Based Remuneration (EEBR) Scheme | Currently, there is tax deduction for treasury shares transferred to employees, there is enhancement in YA2026 where allows a tax deduction on payments to holding companies or special purpose vehicles for the issuance of new shares. The amount qualifying for tax deduction will be the lower of (a) the amount paid by the company; or (b) the fair market value at the time the shares are applied for the benefit of the employee, as reduced by any amount payable by employees for the shares. |

| Enhanced safe harbour exemption | Enhancements to the safe harbour exemption under Section 13W of the Singapore Income Tax Act will expand the scope of eligible gains to include preference shares that qualify as equity. The assessment of the shareholding threshold will also be made more flexible, and the sunset date of the exemption has been removed. These changes provide greater clarity and certainty for investors, making Singapore an even more attractive investment destination. |

| Enhanced tax concessions for S-REITs | Tax concessions for Singapore-listed REITs (S-REITs) will be extended and enhanced. This includes expanding the scope of tax transparency, refining the tax exemption on foreign-sourced income, and extending the GST remission for S-REITs. These measures aim to maintain Singapore’s attractiveness as a REITs hub. |

| Approved Shipping Financing Arrangement Award | A new ASFA Award will provide withholding tax exemption on interest payments and lease payments related to the financing of ships and containers in respect qualifiying financing arrangements entered into on or before 31st Decemeber 2031. This incentive will be available to Singapore-based owners and managers of ships and sea-containers, and aims to reduce the cost of financing for shipping companies and enhance Singapore’s position as a leading maritime hub. |

| Extend and enhance Maritime Sector Incentive | The MSI, which provides tax concessions to various maritime businesses, will be extended and enhanced to cover new areas such as emission management services and maritime technology services. |

| Enhancing infrastructure and green sustainable economy | |

|---|---|

| Changi Airport Development Fund | S$5 billion top-up to support the development of Changi Airport. The Terminal 5 will increase airport capacity, this help to enhance Singapore’s global connectivity and improve supply chain efficiency. |

| Future Energy Fund | S$5 billion top-up to support the clean energy development in Singapore and creating more business opportunities for renewable energy, sustainability solutions and green technology. |

| Coastal and Flood Protection Fund top up | S$5 billion top-up to support the country remains resilient against the climate risks. |

| New schemes to boost the use of clean heavy vehicles | To move towards to clean and green ecosystem in Singapore, goverenment promote transition to clean heavy vehicles with new Heavy Vehicle Zero Emmissions Scheme and Electric Heavy Vehicle Charger Grant. |

| There is a new Additional Flat Component of road tax from range S$190 to S$550 for eletric heavy vehicles. The charges will be introduced gradually over three years beginning in January 2026 and will be fully applied by January 2028. | |

| Supporting Workforce Transformation | |

|---|---|

| SkillFuture Workforce Development Grant | Providing up to 70% funding support for job redeisgn projects. |

| SkillFuture Enterprise Credit | Providing with S$10,000 for eligible companies from second half of 2026 to offset out-of-pocket costs for eligible workforce transformation initiatives |

| NTUC’s Company Training Committee (CTC) Grant | Additional S$200 million to help more companies transform and upskill their workers |

| Strengthening Employment Support | |

|---|---|

| CPF Transition Offset | To cover half the increase in employer CPF contributions for senior workersaged above 55 to 65 |

| Senior Employment Credit | Extend to 2026 to offset wages for hiring senior workers. This to encourage to continue to employ senior workers and benefit from their valuable experience. |

| Uplifting Employment Credit | Extend to 2028 to offset wages for hiring ex-offenders. The extension is to provide second chance to ex-offenders and support them back to community. |

Conclusion

The Singapore Budget 2025 clearly outline the plans to continued support for businesses in embracing technology and innovation to adapt the global economic challenges and stay resilient and competitive, increasing the productivity through reskilling and uoskilling workforce, and providing support from birth to old age particularly for vulnerable groups, ensuring all have been taken care of.