Property Tax

Need help on filing an objection on annual value? B6 handle the complexity for you

The Inland Revenue Authority of Singapore (IRAS) Is the government body responsible for administering and enforcing the nation’s

property tax.

There is a one-off property tax rebate up to 20%, capped at S$1,000 for all owner-occupied residential properties in 2025. The rebate will automatically offset against any property tax payable.

Accounts Tax Secretary

What is property tax, and who needs to pay?

Property tax is mandatory in Singapore. It is a tax on property ownership. It applies whether the owner rented out the property or left it vacant. Whether it is an individual or a legal entity that owns the property, it must be paid when the Tax is due.

It differs from income tax, which is a tax on your earnings, including rental income. Income from renting out the house.

Property tax is allocated to the common pool fund for the development of Singapore. Benefits everyone living in it.

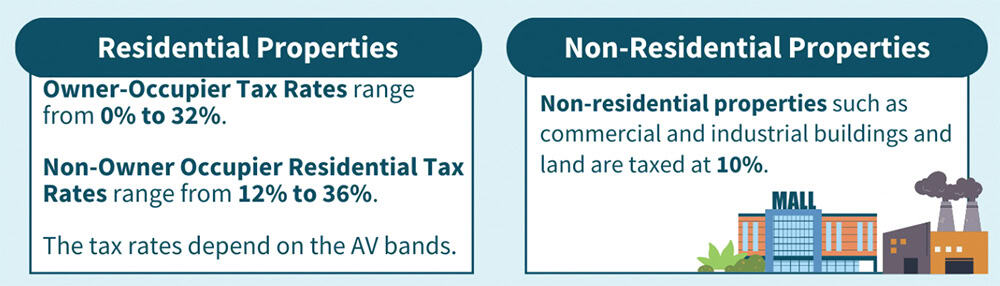

There are different tax rates that apply depending on the property's type and usage. Resident and non-resident imposed a different rate, and some specific categories of properties are exempt from tax. There are some common stamp duty

remissions related to the property as well.

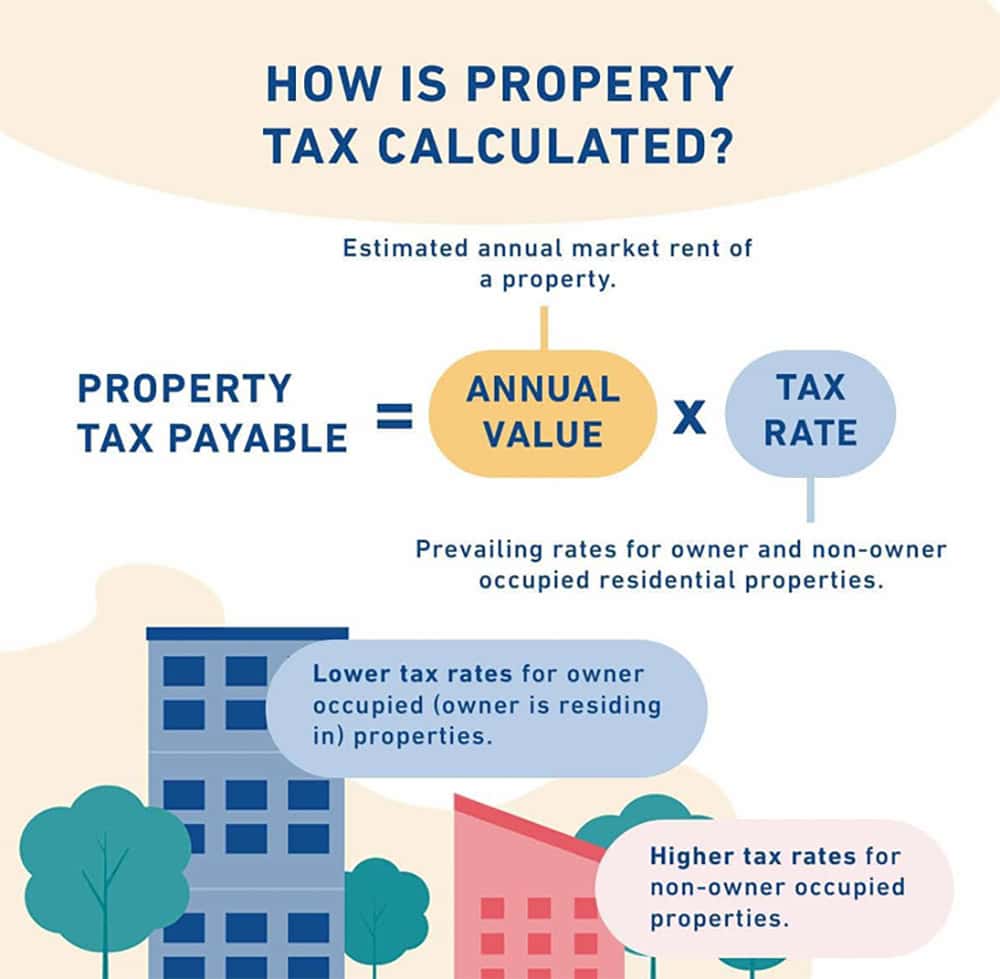

Annual value (AV) refers to the estimated annual market gross rent of the property, not the actual rent, to ensure fairness for all property owners.

To determine the AV, IRAS considers some of these factors:

- The property’s size.

- The property’s physical condition.

- Rent of similar properties in the area.

- The property’s location.

- Other relevant factors that contribute to making an informed decision.

Property tax is payable annually. At the end of each year, you will receive your property tax bill for the following year. Payment is due on 31st Jan.

For ad-hoc property tax notices issued by IRAS, payment is due one month from the date of notice.

Penalties for Non-compliance

Failure to make full payment by the due date attracts a 5% penalty fee on the unpaid taxes. However, IRAS does offer an opportunity for property owners in default to make an appeal for this penalty to be waived. A waiver of the 5% penalty fee will be considered when the entire tax payment is made immediately to IRAS, or if the property owner is regarded as a first-time offender within two years.

If you have filed an objection and are awaiting the outcome, you must still pay the tax as assessed, as shown on the bill. Excess payment will be refunded to you if the bill is revised.

FAQ

-

What is the tax structure for companies in Singapore?

Singapore has a low income tax rate for corporations, which is charged at a flat rate 17%

Singapore does not impose a capital gains tax, and it can distribute tax-free dividends to its shareholders. -

What is Form C or Form C-S?

Form C and Form C-S are both corporate tax returns to be e-filed with IRAS on an annual basis.

The Form C-S, being a simplified version of the Form C, contains fewer fields to fill. The Form C-S mainly comprises the following:- - A declaration statement of the company’s eligibility to file the Form C-S.

- - Information on tax adjustments (i.e. adjustments for non-taxable income and non-deductible expenses);

- - Information from the financial accounts

-

How do you calculate Corporate Tax return in Singapore?

You can calculate corporate tax returns manually or using tax preparation software. You need to calculate the taxable income and submit it to the IRAS online. You can use the IRAS' portal to file your tax returns online. It is all time-consuming.

Let's B6 handle the complexity for you!